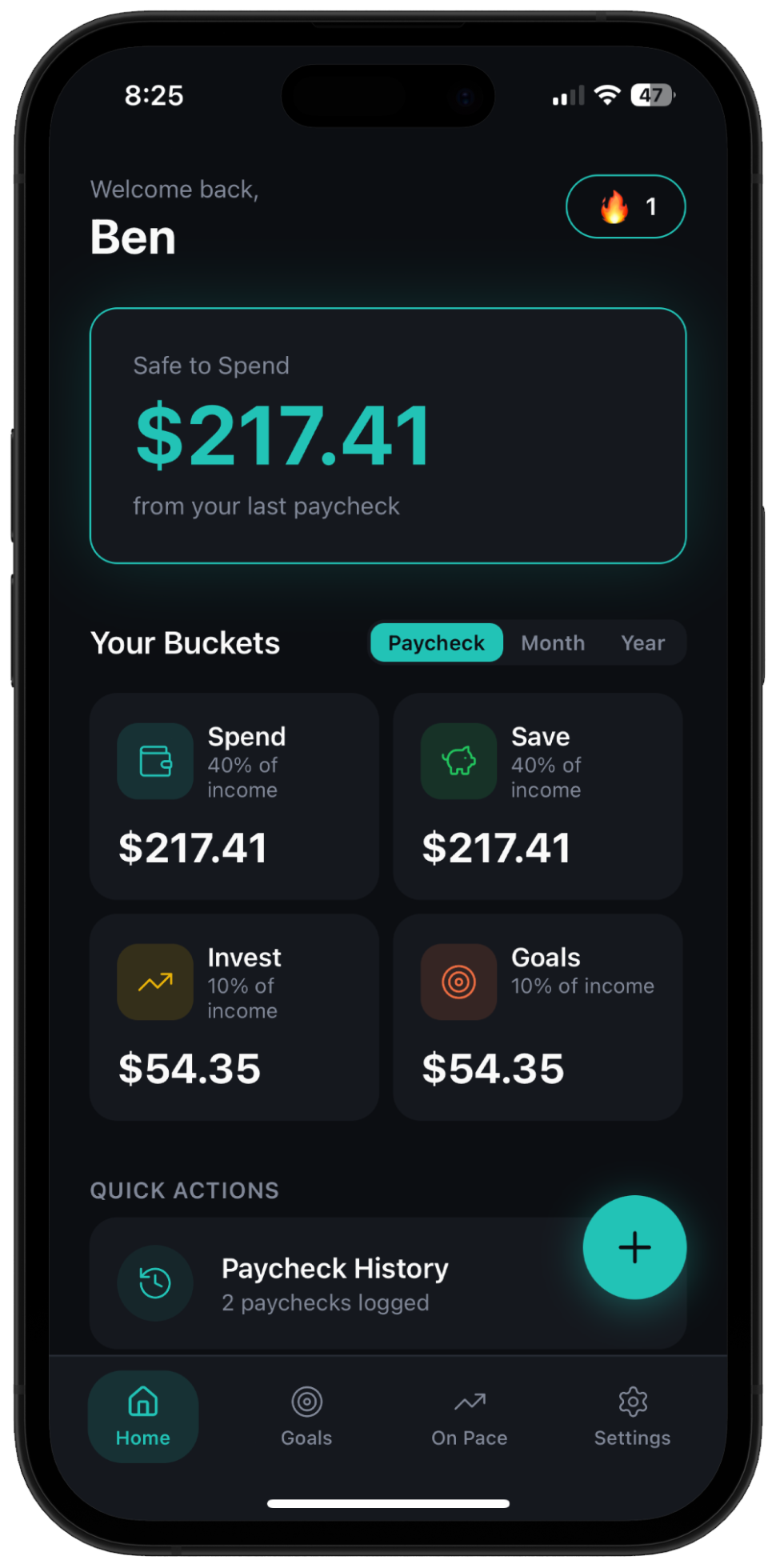

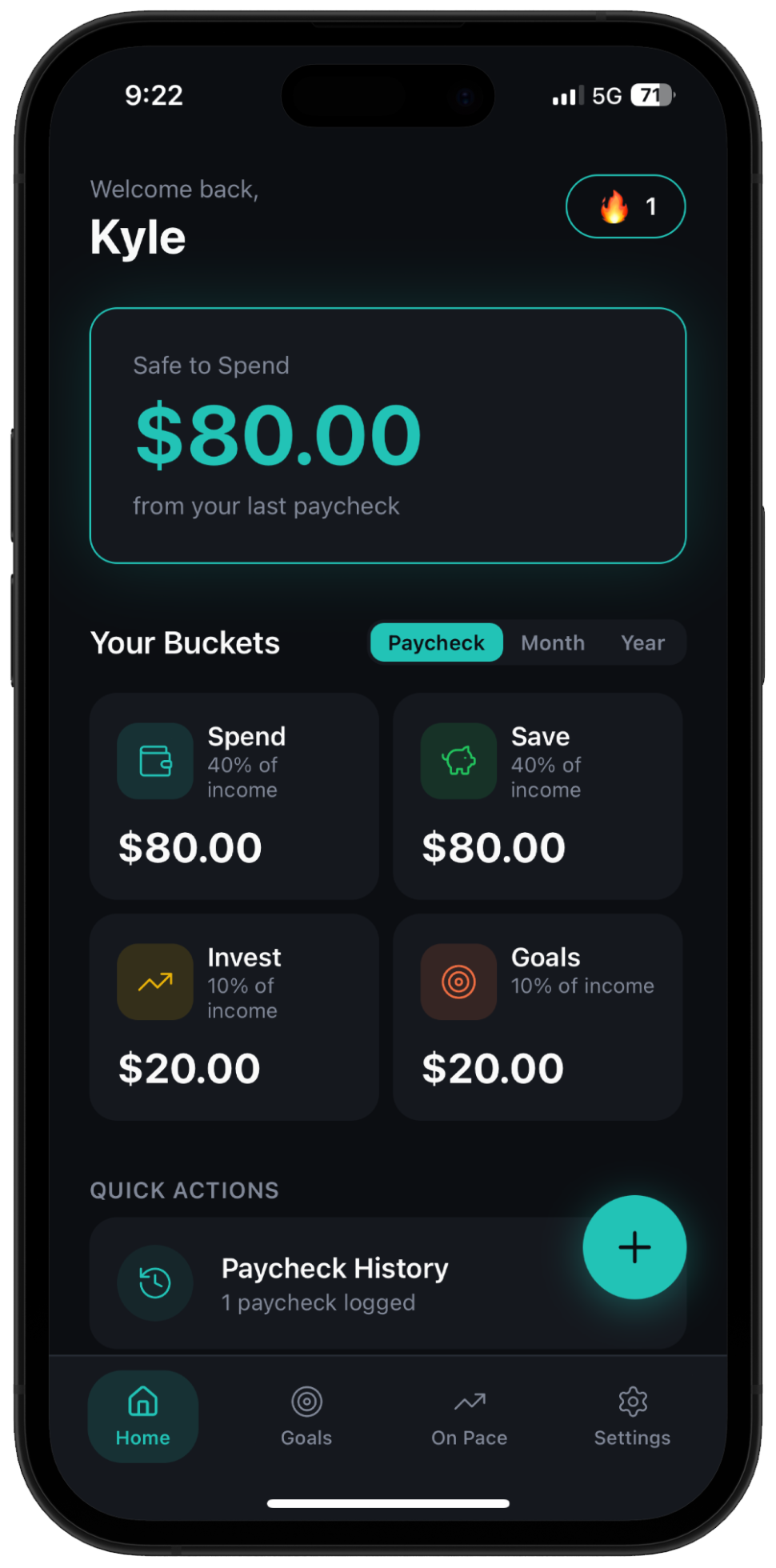

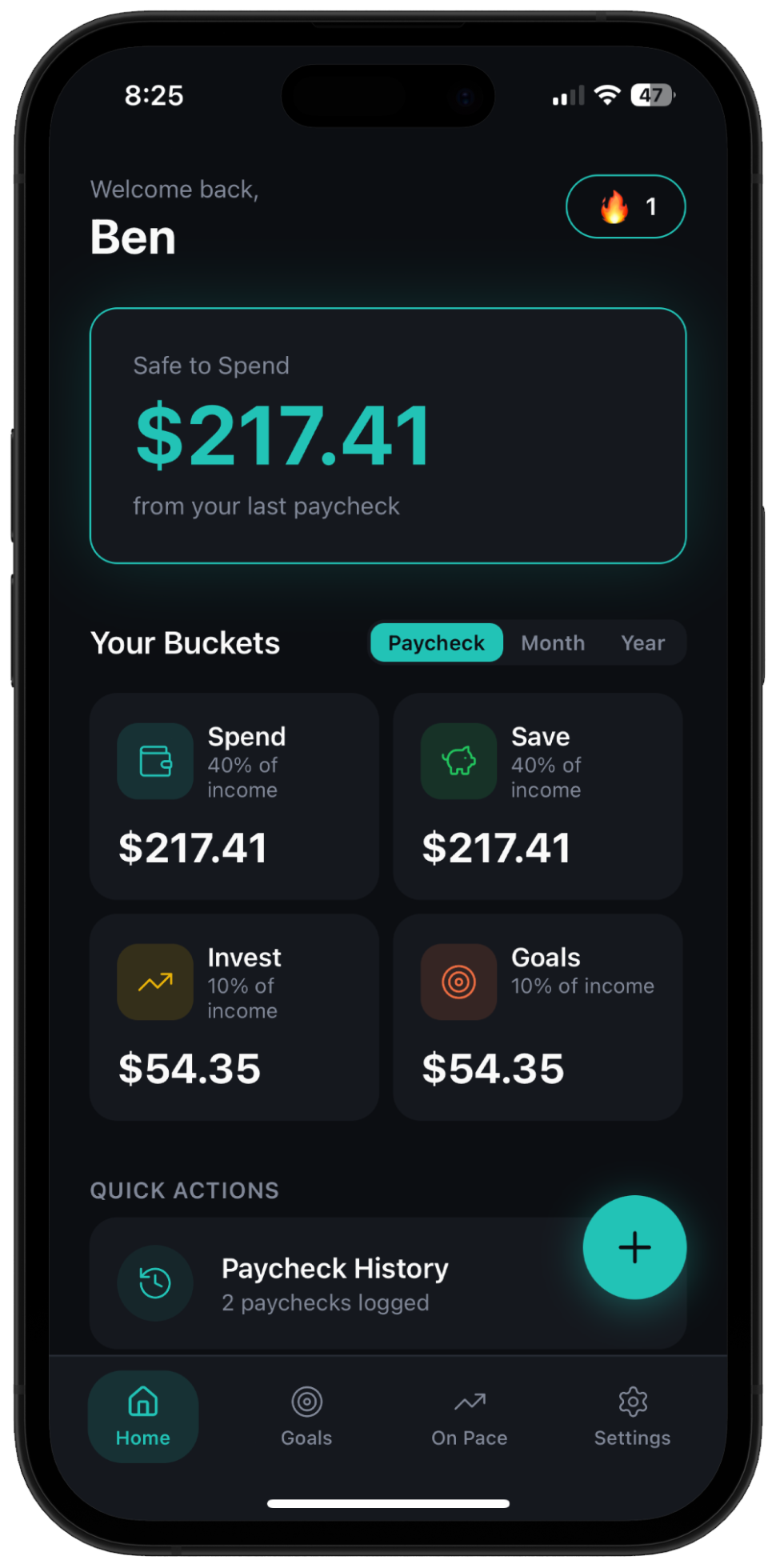

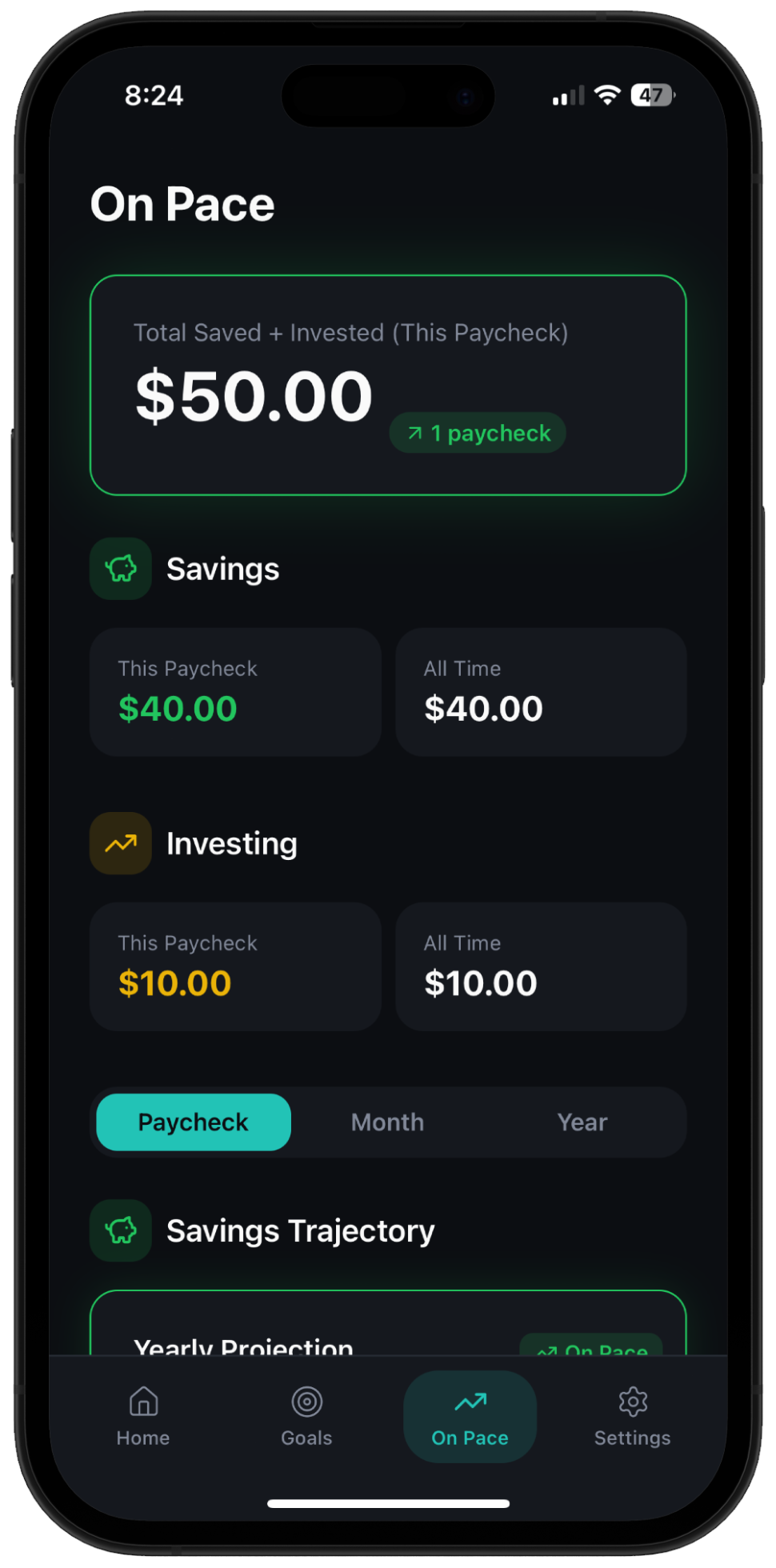

North splits every paycheck into Spend, Save, Goals, and optionally Invest — so your teen always knows what's safe to spend.

They're earning real money for the first time. Without a framework, every dollar disappears — and so does the lesson.

Every paycheck without a plan is a missed opportunity.

Whether you're a parent, a teen, or going solo — North meets you where you are.

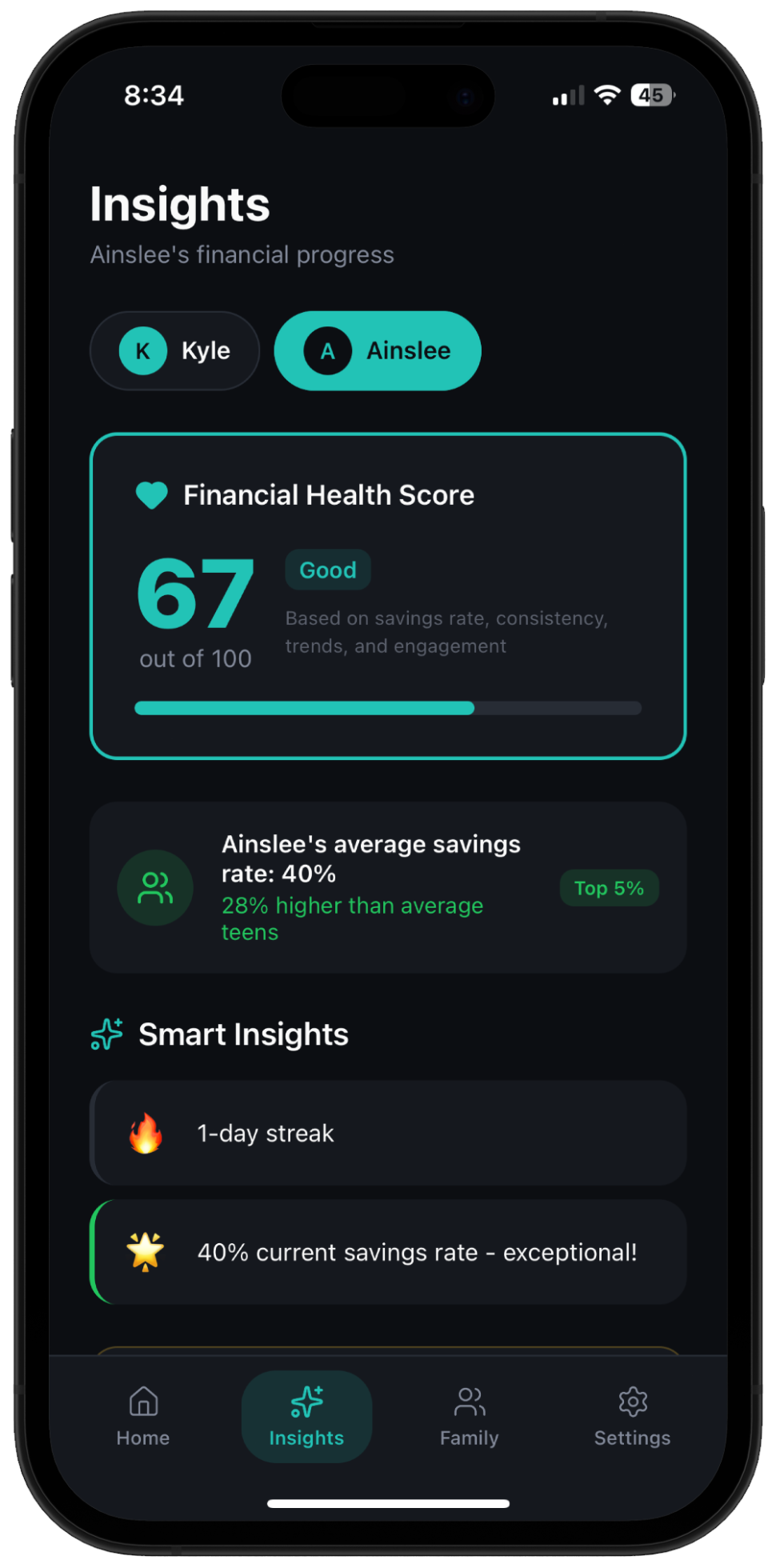

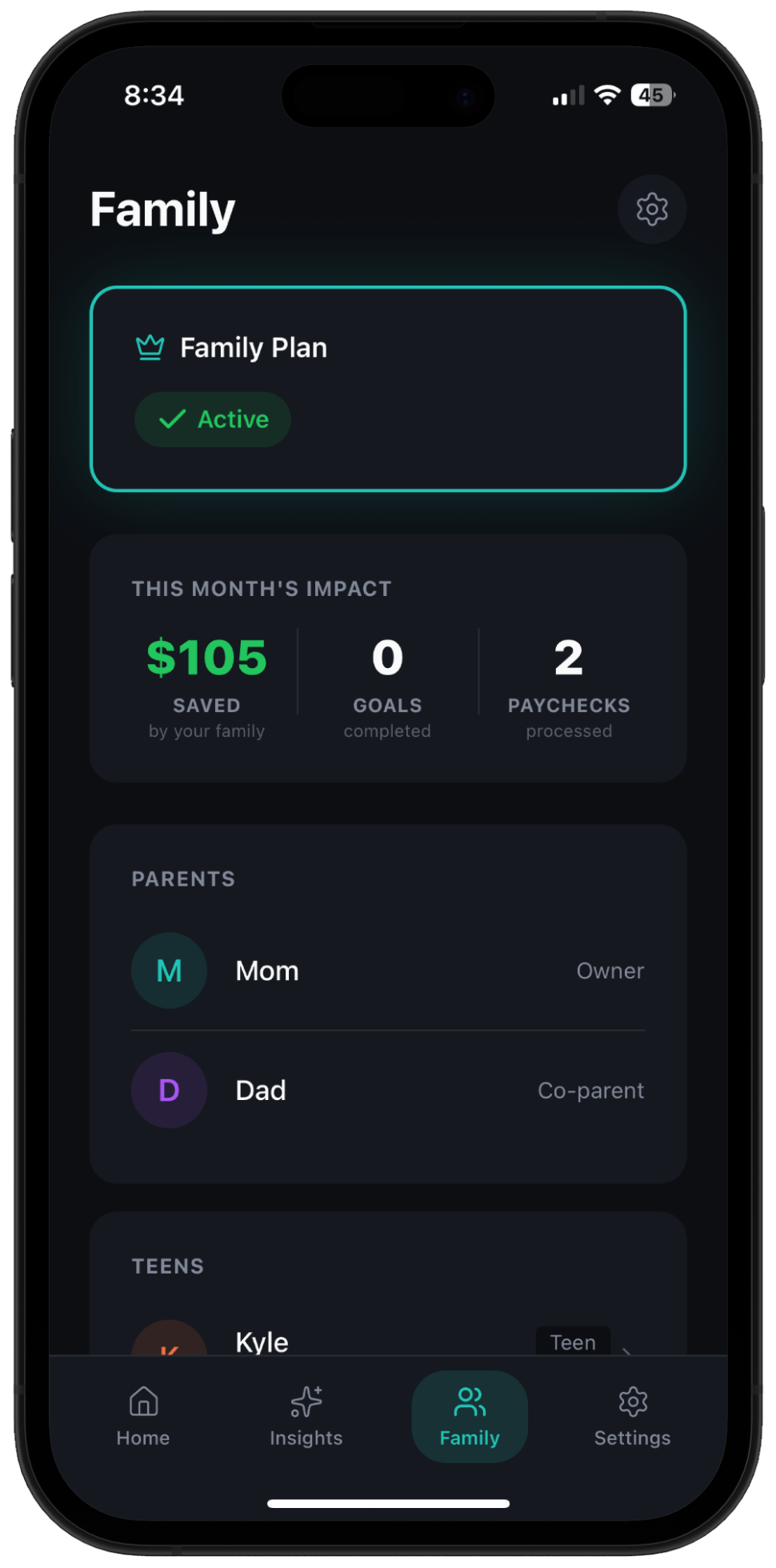

Adjust their budget split anytime and let your teen handle the rest. Full visibility into their progress without micromanaging every dollar.

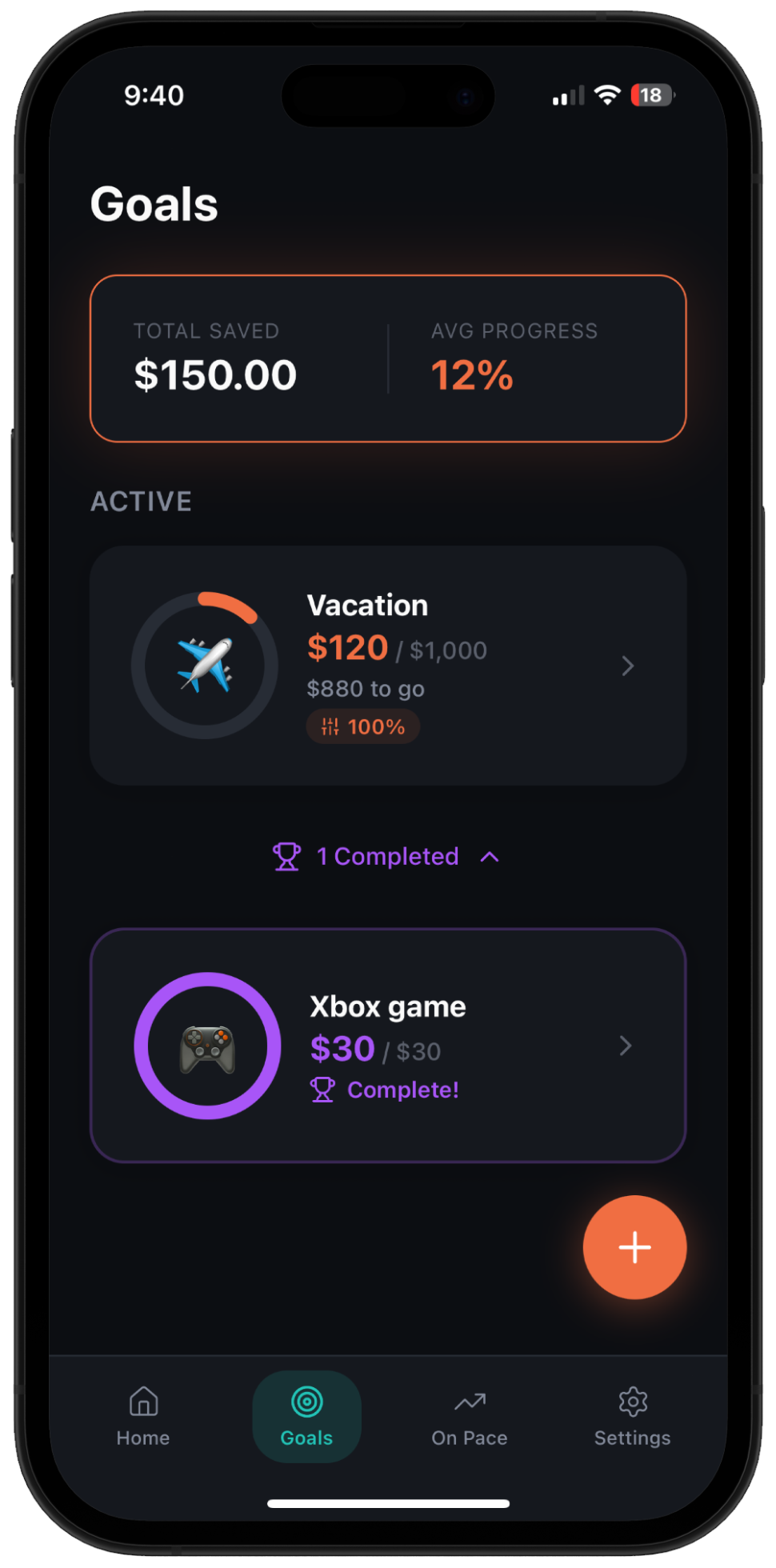

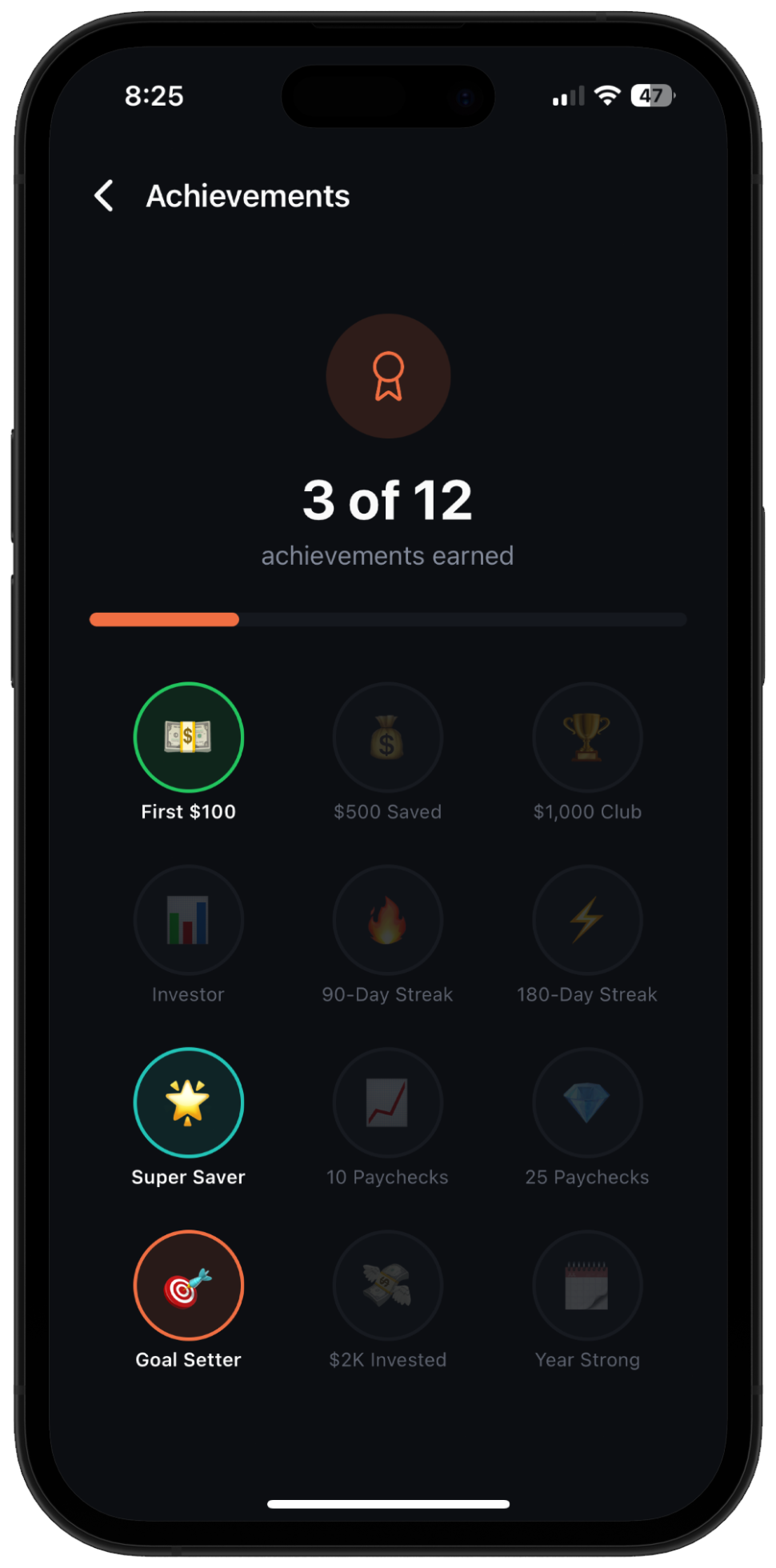

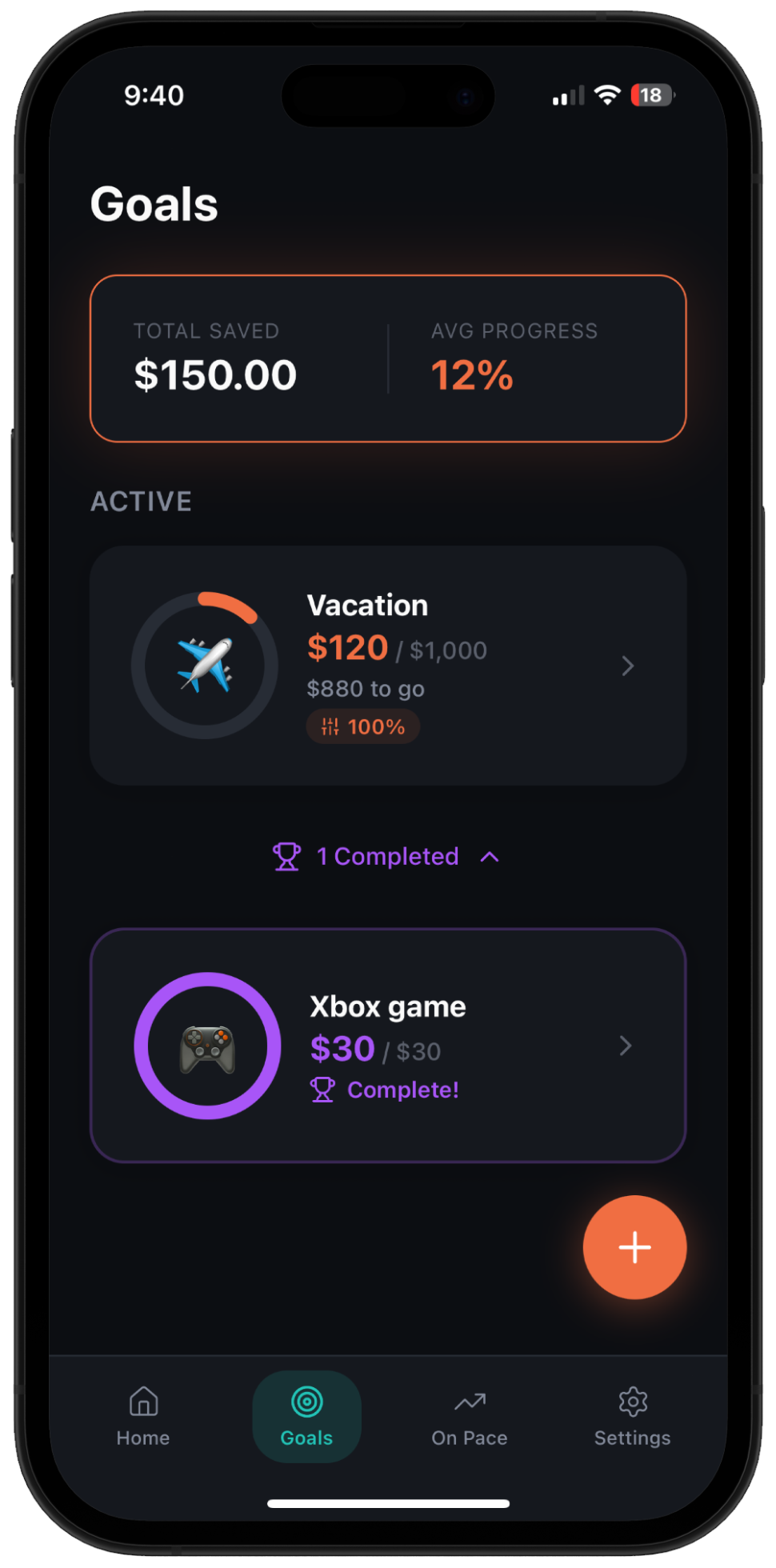

Get your safe-to-spend number instantly after every paycheck. Choose your money personality, set goals, and build streaks that actually matter.

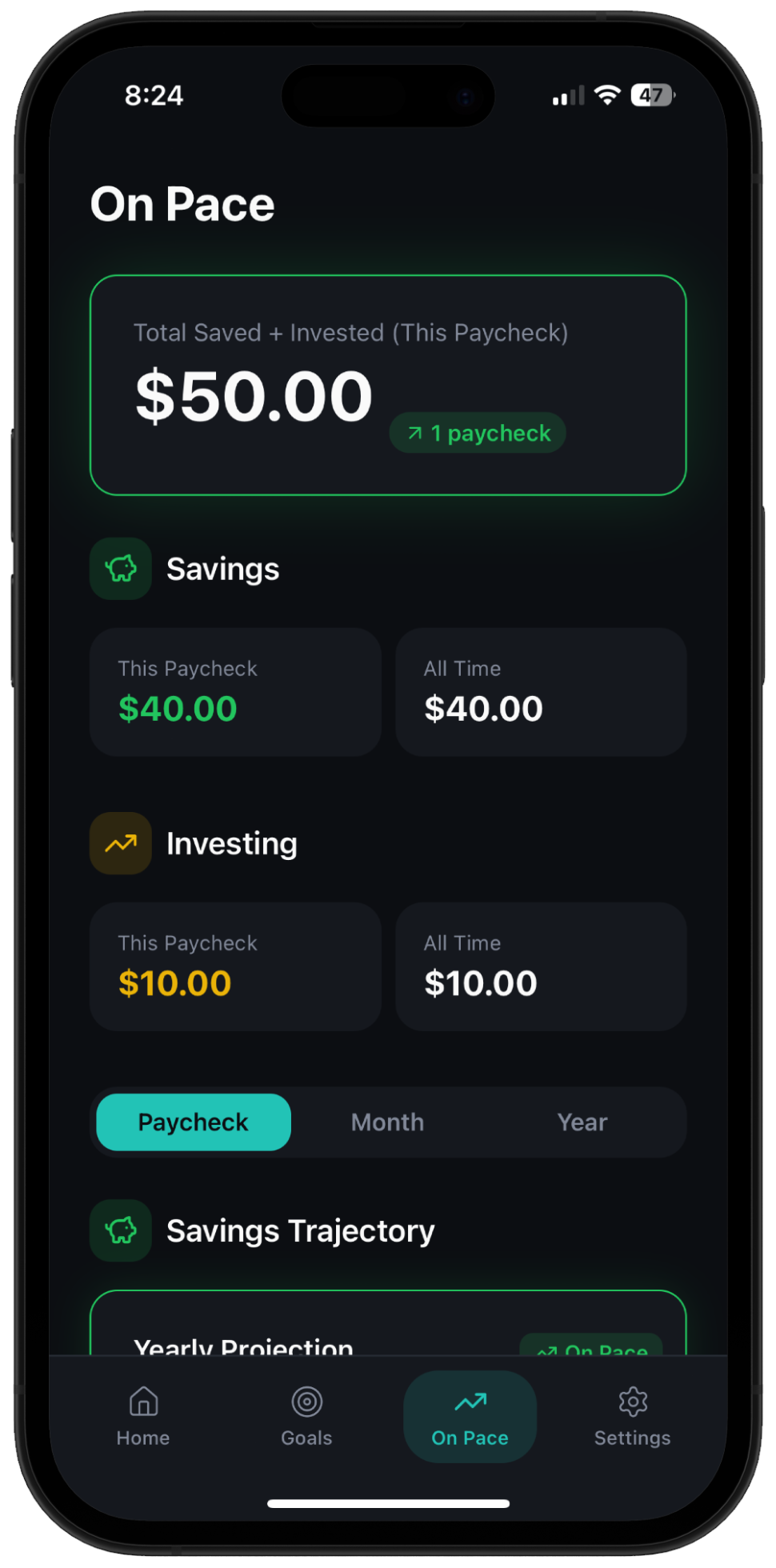

Independent young adults get everything they need — paycheck splitting, goal tracking, Roth IRA projections, and full analytics.

Every paycheck splits into four buckets. Instantly know what's safe to spend.

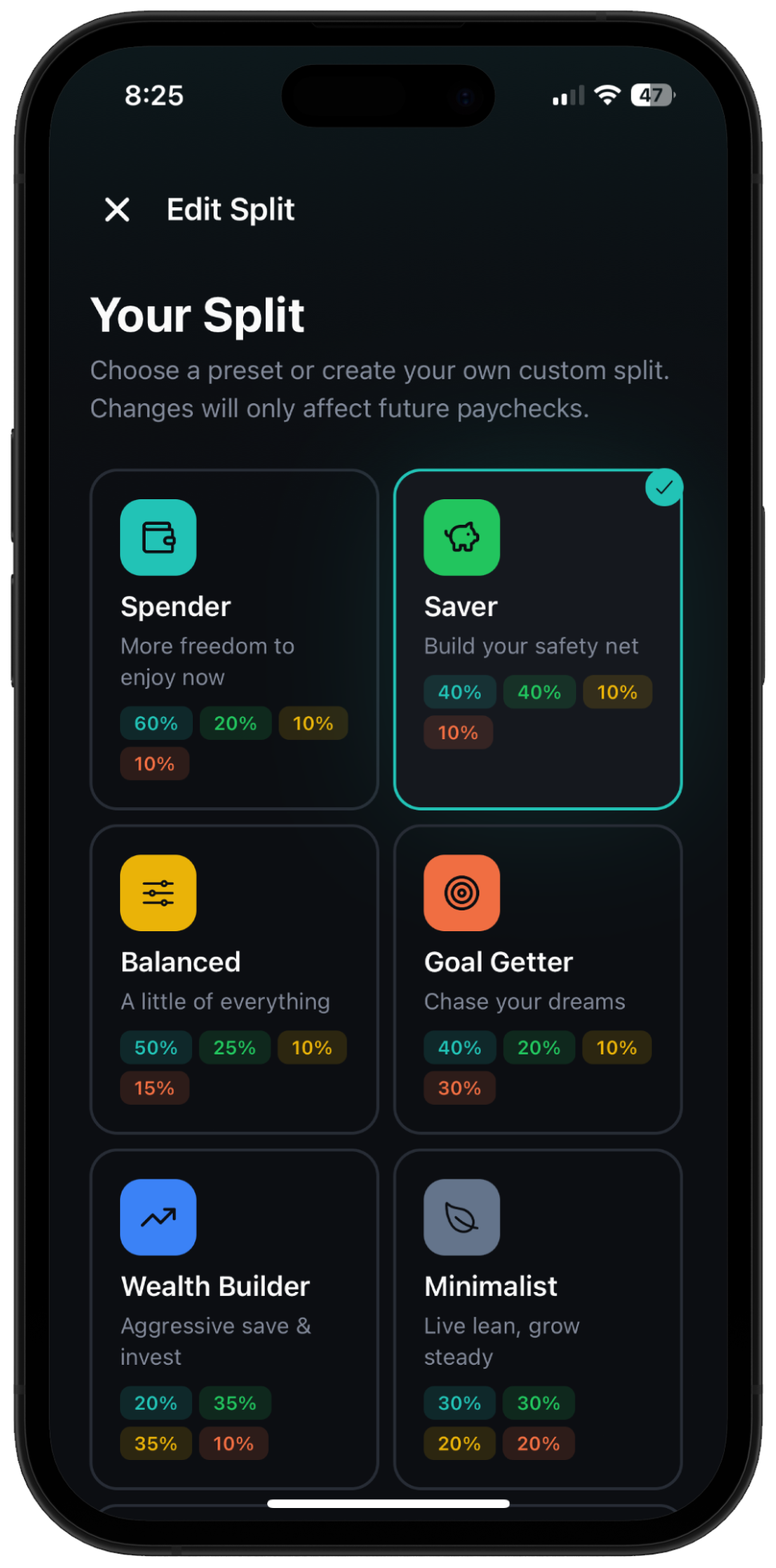

Pick a money personality — Spender, Saver, or Goal Getter — and North sets your bucket percentages automatically. Customize anytime.

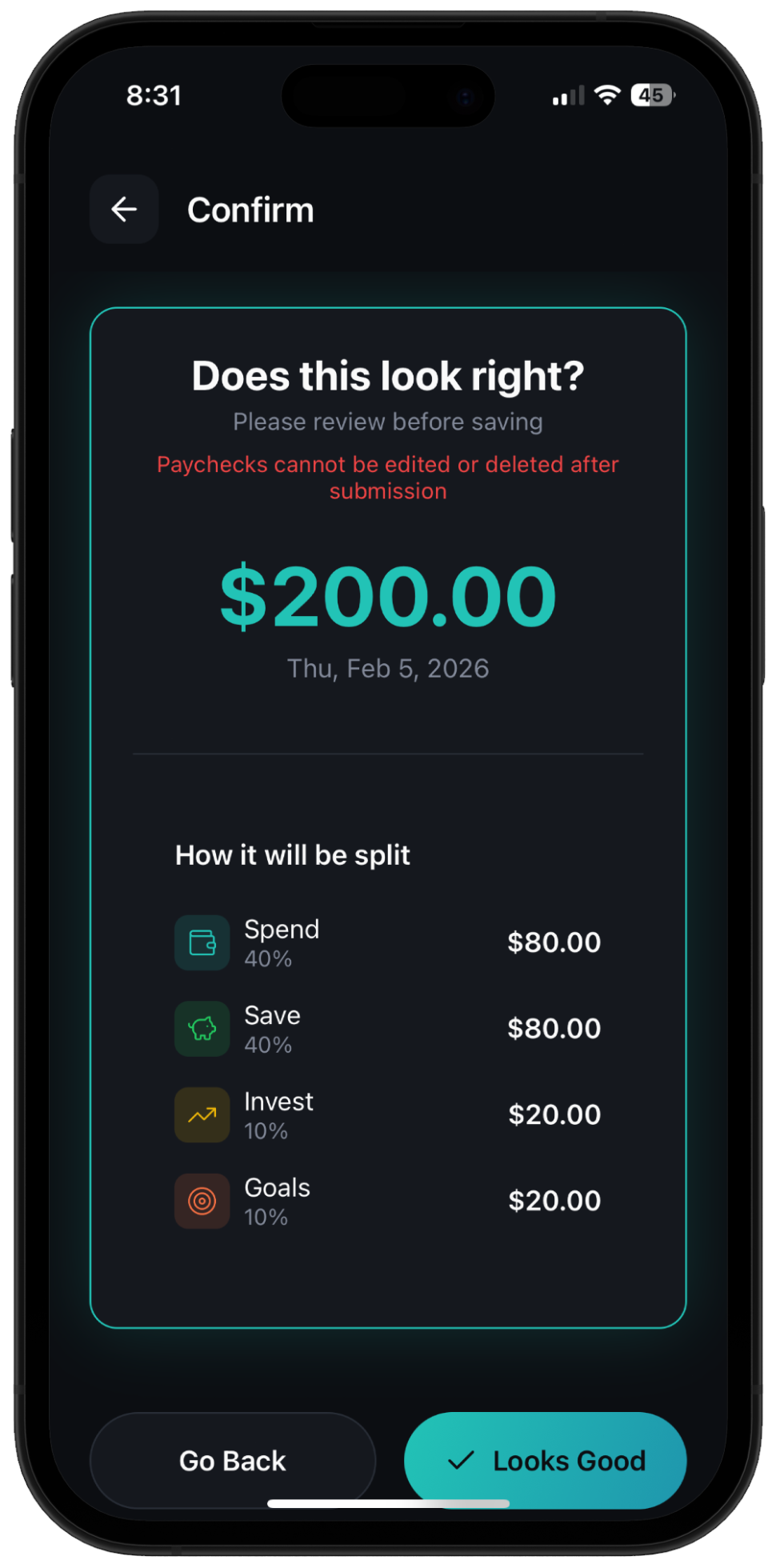

Enter your earnings and watch a live preview show exactly how your money splits across all four buckets. Your safe-to-spend updates instantly.

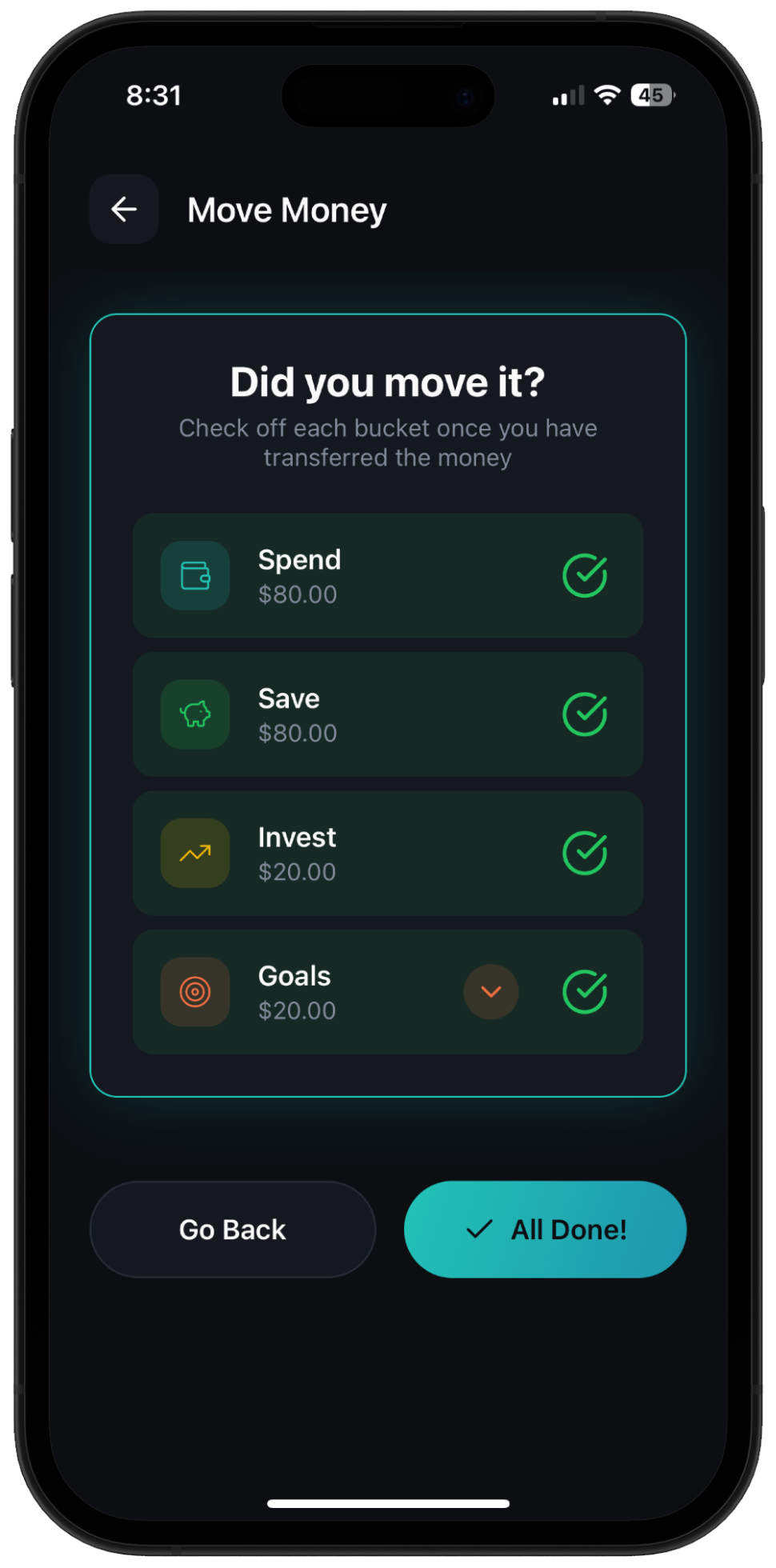

Follow a simple checklist to physically move your money into the right places. Check off each bucket as you go — it's that satisfying.

Your next paycheck is coming. Will you spend it all — or split it and grow?

Small splits. Big futures.